Buying time: York Region residents live with Greater Toronto’s highest debt loads as they pay off ‘unattainable’ homes

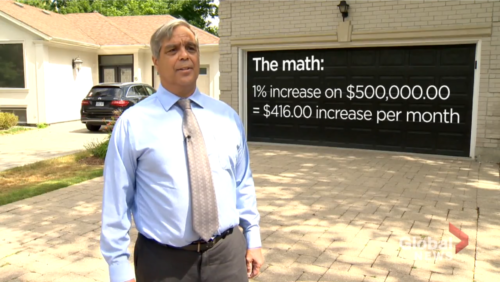

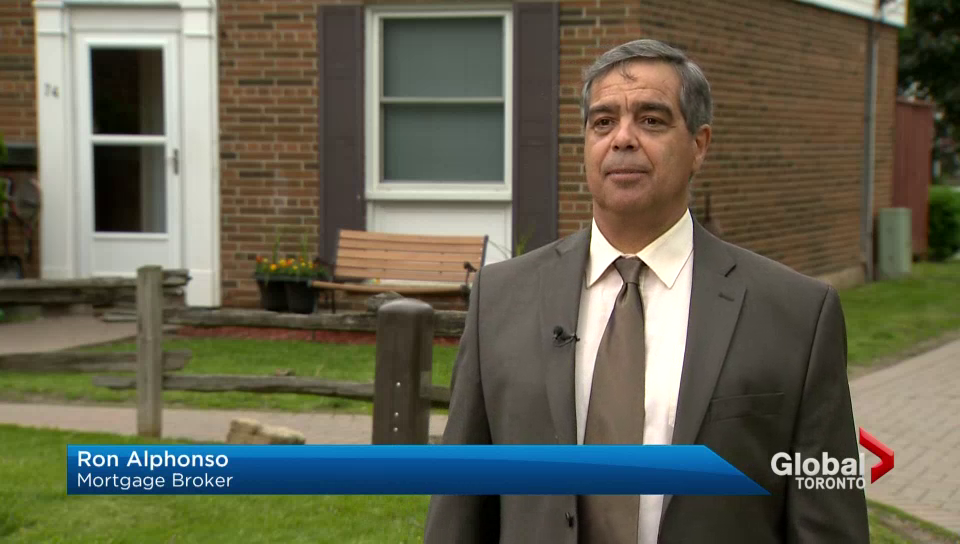

York Region – Apr 4, 2025 – York Region residents are grappling with soaring debt levels as housing becomes increasingly unaffordable, even in traditionally more affordable areas like Newmarket and Georgina. Many homeowners are relying on credit cards, private loans, and lines of credit to make ends meet, often pushing themselves deeper into debt. The emotional attachment to homeownership keeps people from selling, even when they can no longer keep up with payments. Jonathan Alphonso, a realtor and private lender, sees firsthand how deep people are getting into debt just to hold onto their homes.

Read the Full Article