York Region – Jan 13, 2026 – In memory of Ronald, who died in 2025, the family honoured the beloved husband and father by establishing the Ronald Alphonso Award. Because reinvention was such a defining part of Ronald’s career, this annual award will support a full-time MBA student in financial need who is reinventing themselves as part of a career transition with $3,000 toward their education.

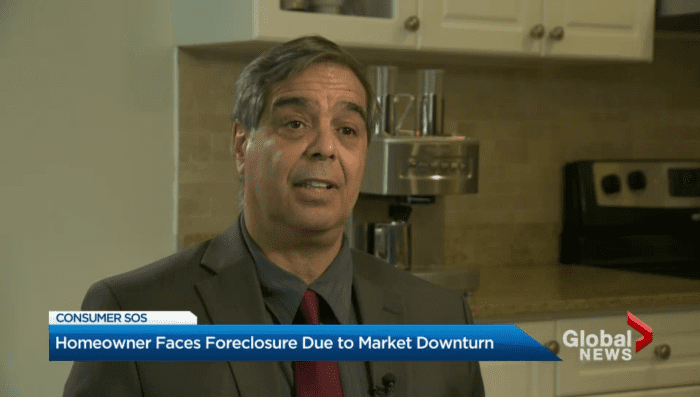

York Region – Nov 3, 2025 – Lenders are seizing more homes, especially in the suburbs, where up to 1 in 10 are now listed in power of sale.

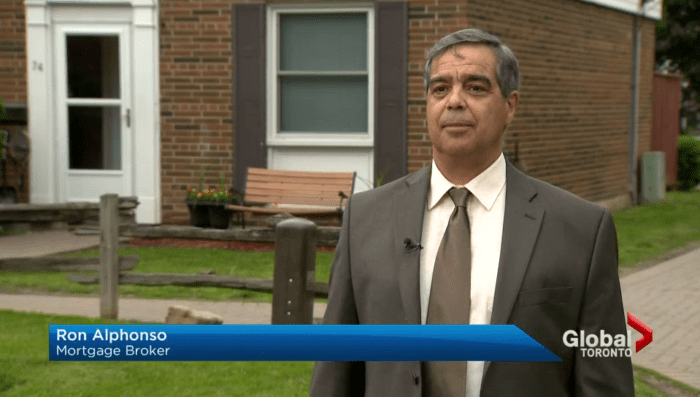

Toronto Star – Mar 31, 2023 – Mortgage Broker Store’s president, Ron Alphonso, emphasizes the importance of implementing mandatory regulations to assist clients with variable rate mortgages, as relying on the voluntary efforts of lenders might not adequately address the needs of all customers.

CTV News – Mar 8, 2023 – With the increased use of private lender financing some Canadian homeowners are having difficulty making all their mortgage payments. Ron Alphonso discusses general mortgage trends and the situation of one of Ron’s private mortgage clients.

Toronto Star – Mar 7, 2023 – The percentage of Ontario borrowers with private mortgages has hit roughly 20%, says Ronald Alphonso of Mortgage Broker Store. He predicts 5% to 10% of those mortgage holders will default due to rising rates.

National Post – Jan 12, 2023 – The Greater Toronto Area has recently seen a string of fraudulent house transactions. The cases involve sohphisticated criminals with fake identities. Ron speaks on the nature of real estate fraud in Toronto and what homeowners can do to protect themseleves.

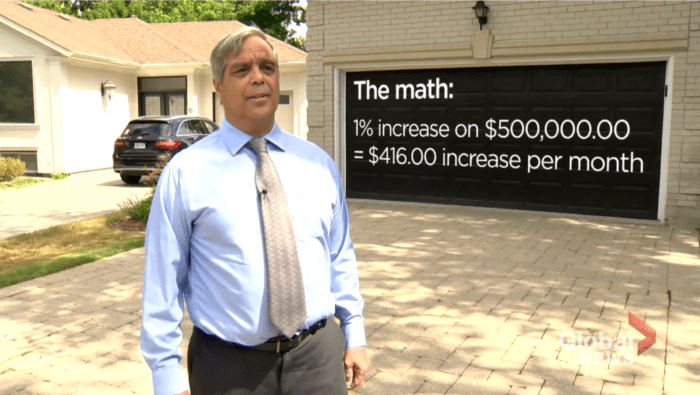

Global News – Jan 10, 2023 – With high house prices and increasing interest rates and inflation, many Toronto homeowners are struggling to keep their homes. Ron Alphonso explains the factors involved and what to expect in the near future.

Global News – Jan 6, 2023 – In January 2022, a Toronto couple returned from vacation to find that their home had been sold without their knowledge or consent. Ronald Alphonso discusses the system involved in land registry and how something like this could happen.

Global News – Apr 5, 2017 – Houses in the Greater Toronto Area have been reaching record prices and many Canadians cannot afford to buy a home. Many current homeowners with low-interest mortgages, but Ron explains that he is beginning to see people struggle with the costs of owning a home.

Toronto Star – Aug 1, 2016 – We helped Toronto Star journalist Sunny Freeman explain the consequences of court battles with mortgage lenders.