Canadian mortgages in arrears pose significant challenges for homeowners, often leading to financial strain and potential risks such as power of sale. Individuals struggling to meet mortgage payments may face penalties and interest growth, exacerbating their financial burden.

Understanding Mortgage Arrears

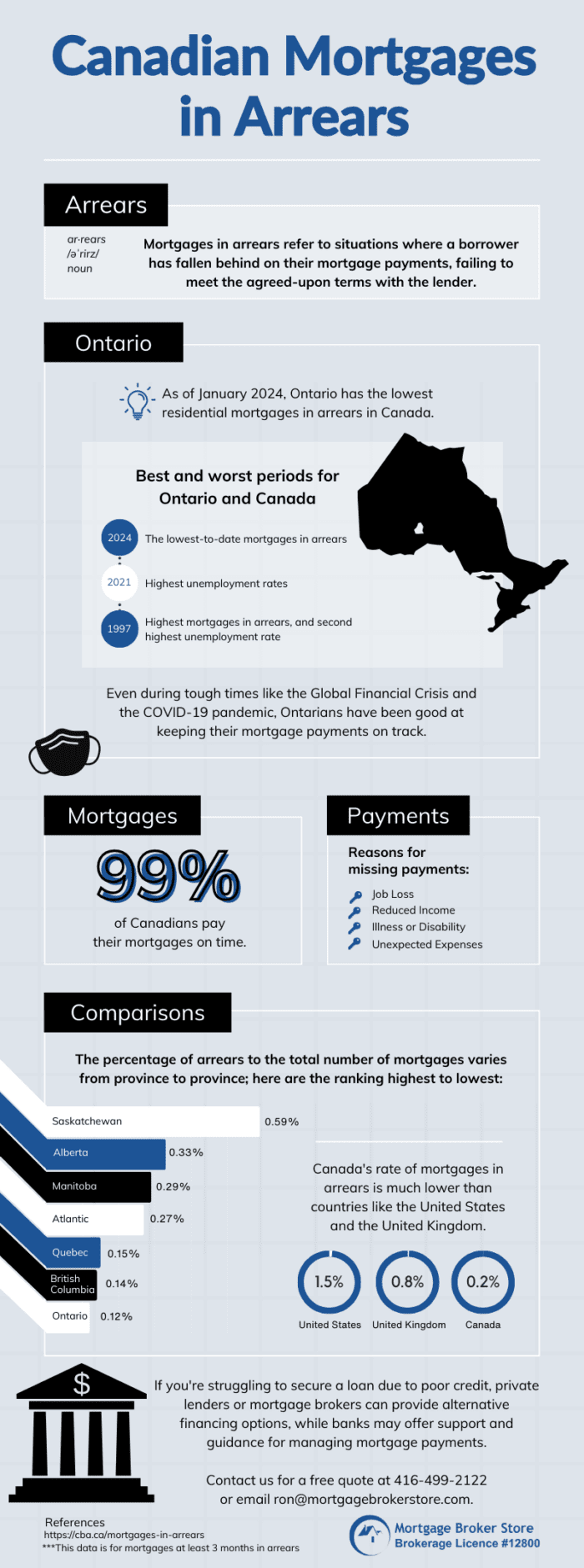

Mortgages in arrears denote instances where borrowers have fallen behind on their mortgage payments, failing to adhere to the agreed-upon terms with the lender. This phenomenon can stem from various factors such as job loss, reduced income, illness, or unexpected expenses. In the Canadian context, mortgage arrears represent a fraction of the overall mortgage market, yet they provide valuable insights into the financial well-being of households and the broader economy.

Ontario’s Exemplary Track Record

As of January 2024, Ontario boasts the lowest residential mortgages in arrears across Canada. This achievement highlights the province’s resilience and financial prudence, even amidst economic downturns and global crises. Throughout turbulent periods like the Global Financial Crisis and the COVID-19 pandemic, Ontarians have consistently demonstrated their commitment to meeting mortgage obligations, setting a benchmark for mortgage repayment reliability.

Comparative Analysis

When compared to other provinces, Ontario’s low percentage of mortgages in arrears stands out prominently. The percentage of arrears relative to the total number of mortgages varies across provinces, with Saskatchewan and Alberta experiencing relatively higher rates. However, Ontario’s steadfast performance places it at the forefront of mortgage payment adherence in the Canadian landscape.

International Perspective

On the global stage, Canada distinguishes itself with remarkably low rates of mortgages in arrears compared to countries like the United States and the United Kingdom. Canada’s mortgage arrears rate remains low, contrasting with rates over 1% in other nations.

Navigating Financial Challenges

For individuals encountering difficulties in managing mortgage payments, various avenues of support are available. Private lenders and mortgage brokers offer alternative financing options, catering to borrowers with poor credit or financial constraints.

In the intricate realm of Canadian mortgages, understanding the dynamics of mortgage arrears is paramount. Ontario’s exemplary performance in maintaining low rates of mortgages in arrears underscores the province’s financial resilience and responsible borrowing practices. Stay informed, proactive to uphold housing market stability, fostering economic prosperity for generations in Canada.

Struggling with bad credit? Private lenders or mortgage brokers offer alternatives. Contact us for a free quote at 416-499-2122 or email ron@mortgagebrokerstore.com.