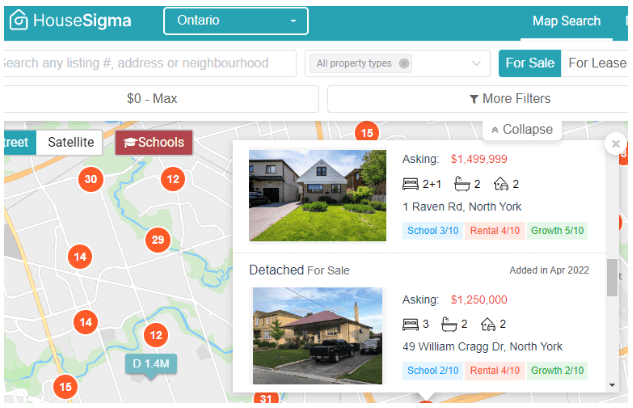

Housesigma.com is a convenient online platform for anyone interested in finding the market value of any home. It’s also great for finding homes for sale in any neighbourhood.

Visitors to the website can look up property prices, property sale history, potential rental income, and market trends. Housesigma.com is widely used in Ontario and British Columbia, with over one million visitors per month in the Greater Toronto Area (GTA) alone.

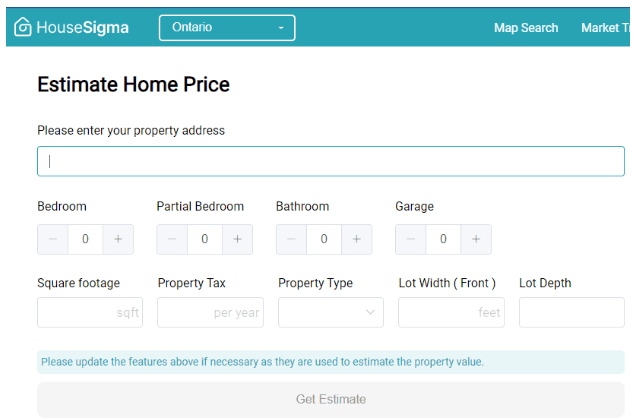

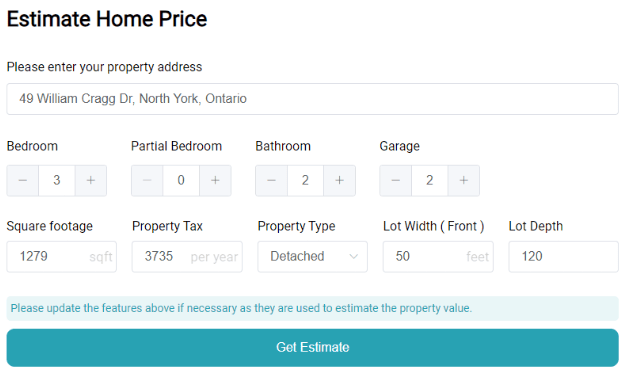

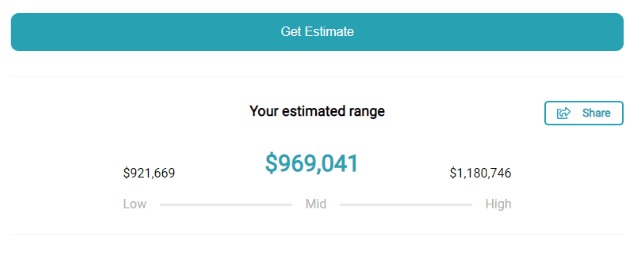

Housesigma provides a free real estate price estimator tool. It is quick and easy to use, based on an address of property of interest.

Pros and Cons of Housesigma’s Real Estate Estimator Tool

Pros

- Housesigma is entirely free.

- The tool is very user-friendly.

- The platform loads very fast, and the tool can calculate prices in an instant.

- With just the address, a user can get a ton of information about the home.

Housesigma doesn’t force you to give any personal information in order to use the real estate price estimator tool. Many other real estate websites and apps that offer free tools require your contact information before you can access their tools. Housesigma can give you an estimated price range for a given property right away without signing up. However, in order to view the sold prices of comparable properties you will need to sign up with an email. This is due to the regulations surrounding access of sold property data. Ontario’s real estate boards require any website that offers sold property data to require some sort of user login to access the data.

When using Housesigma with a free account, you can view comparable properties that were sold or are for sale. This is usually extremely valuable when determining whether to make an offer or how to price your property for sale.

Cons

Users should be reminded that the estimator does not guarantee the value of a home. It is ususally not as reliable at predicting future market trends.

- Does not have data on privately sold homes.

- Limited to properties in Ontario and British Columbia only.

- The tool is not as effective in rural regions as it is in urban centers.

Why We Love Housesigma’s Real Estate Estimator Tool

With Housesigma, homebuyers, sellers, real estate agents and investors can gauge the current market value of a home without spending any time or money on an in-person appraisal. Instead, they can get estimates in seconds.

This tool helps homeowners review selling prices of comparable homes, which can help them set the right price to sell based on their desired results. It also helps buyers determine the right offer to make on a home so they get the home they want. For homeowners looking to refinance their mortgage, they can look up their home’s current market value to find out how much equity they have.

At Mortgage Broker Store we have been using this tool since it was created and it is one of the most accurate home pricing tools we have ever used. Mortgage professionals use it to look up clients’ estimated property value when determining eligibility for a home equity loan as well as the size of the loan. Because the tool is so fast and easy to use, our mortgage professionals can provide answers to clients without delay.

How This Tool Compares to Professional Appraisals

Housesigma uses comparative sales analysis to determine the value of a property. Housesigma uses artificial intelligence to conduct pricing analysis, meaning pricing is calculated instantly. Professional appraisers use the same data, but it takes them longer to evaluate property, and they usually charge hundreds for their services.

Comparative sales analysis is the process of identifying the selling information for several similar properties that have sold in a given area. Finding the range of selling prices, or the average selling price, is a method professional home appraisers use to determine the market value of a property.

Comparative sales analysis measures various factors, including property size, building type, amenities, previous sale price, and property age.

While Housesigma is a great tool to use, like all online real estate tools, they have some limitations compared to professional appraisers.

A professional appraiser stands as the industry standard for home evaluations, recognized for their expertise and thoroughness. A professional appraiser will personally inspect a property; they can provide the most accurate price estimates possible. They possess the ability to identify defects and other features often overlooked by online tools. Home appraisers have no agenda, as they do not make any extra income by providing high or low-home appraisals.

Since appraisers are constantly inspecting homes on a regular basis, they can better predict future pricing trends and market fluctuations. If you want to determine the market value of a home with utmost accuracy and reliability, it’s best to rely on the services of professional appraisers. They are indisputably the most reliable and trustworthy source for this purpose. Real estate appraisers are tightly regulated, and most lenders will insist that they have at least one professional designation: Canadian Residential Appraiser (CRA) or Accredited Appraiser Canadian Institute (AACI).

Housesigma is a highly innovative and useful tool, but it is most effective when used alongside a professional appraisal, not as a replacement for one.

Users can access this data from Housesigma for every home in its database, enabling them to conduct comparative sales analysis or obtain results.

Housesigma’s Price Estimator vs Other Real Estate Tools

Housesigma’s estimator tool was compared to other popular real estate tools, including Zoocasa, Zillow, RBC, WOWA and Properly.ca.

Toronto Real Estate Agent Scott Ingram compared Housesigma to Zillow and Zoocasa. He found that all three of the tools tended to underestimate home values. Housesigma generally estimated lower home values more frequently than Zillow and Zoocasa, however he concluded that Housesigma’s estimates were the closest to real home prices out of the three tools.

Ingram also mentioned that he uses Housesigma on a regular basis due to its fast results and user-friendly design. Ingram said. ‘It’s way easier to look stuff up remotely there than trying to log into TREB’s clunky and mobile-unfriendly MLS.”

Zillow and Zoocasa are quite popular in North America, however, in Ontario, the price estimator tools for RBC, WOWA and Properly.ca are more common. The RBC price estimator tool most often provided home value estimates that were significantly different than the values provided by the other tools, and the highest estimates.

Properly.ca provides home estimates exclusive to members, necessitating membership for access, whereas Housesigma’s tool is accessible without membership, providing recent home sales data upon login. This accessibility advantage positions Housesigma ahead. Additionally, WOWA offers estimates for properties and neighbourhoods nationwide but lacks detailed information. In contrast, Housesigma offers extensive property details, enhancing its utility for real estate buyers in Ontario and British Columbia.

While each tool requires very few steps to get a home estimate, Housesigma is by far the most convenient. Enter the property address, and the tool automatically fills in the remaining details, simplifying the process for users. AI-driven Housesigma delivers instant, accurate real estate data for any property in Ontario and British Columbia, proving invaluable.

The team at Mortgage Broker Store uses Housesigma to find the right properties for clients. The volume of data offered for each home listing is unrivalled when compared to other real estate tools. Housesigma helps us make decisions faster, which is vital when making bids on active properties. Do you have further questions? Reach out to our team directly at 647-363-6911 or by email at ron@mortgagebrokerstore.com.