One thing that we pride ourselves on at Mortgage Broker Store is our ability to deal with difficult power of sale and foreclosure situations. Since we are generally well known for this expertise, we get many calls related to legal issues with mortgages. This specialization gives us a general idea of the state of mortgages in Ontario. Why have banks been sending power of sale warning letters? We’ve looked through our website statistics and the number of inquiries we’ve received and have come to some general conclusions.

Firstly, since the end of March 2020, the number of mortgages we’ve arranged with the goal of stopping a power of sale has been reduced by about 70%. We believe this is due in large part to the government’s mortgage deferral plan implemented around the same time. When speaking with different industry people, such as lawyers and property managers, they also let us know that their bosses asked them to stop work related to evictions. This would mean that even people who didn’t explicitly defer their mortgage would have their evictions delayed significantly.

Mortgage Deferrals

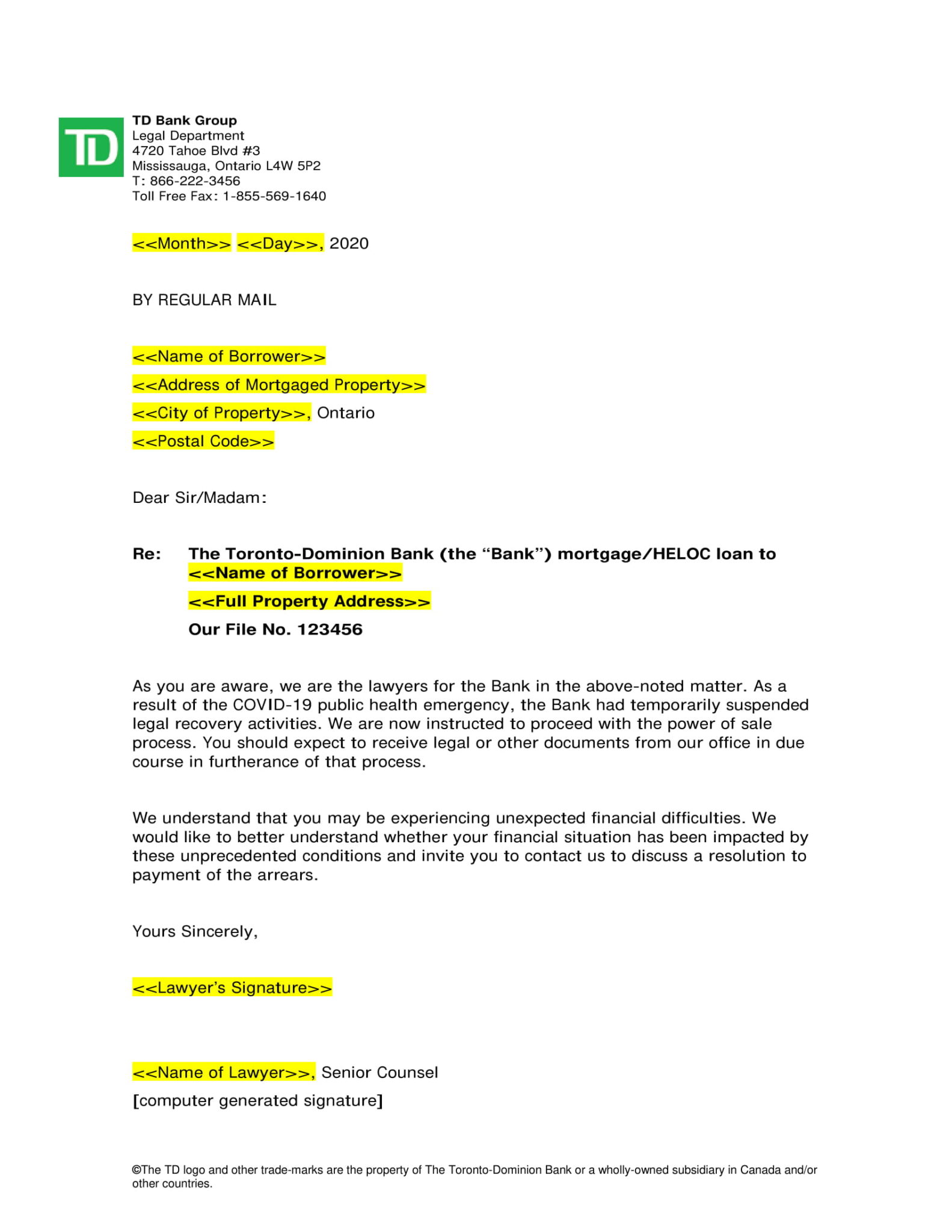

During our entire mortgage career, we have never received multiple similar phone calls in a single day, making this an unprecedented occurrence. We’ve gone ahead and recreated one of these documents while stripping away all personally identifiable info. Ron Alphonso has also created a short video explaining the document. Both the sample document and video can be seen below.

The common date mentioned during the borrower’s conversations with their lenders was Sept 11th. This was the date that the lenders stated they were going to proceed with power of sale and most likely send a Notice of Sale document. The language used in the warning letter seems understandable, and we’d assume that the banks are going to be more lenient than usual when it comes to dealing with people impacted by financial difficulties. One thing we recommend that all our clients do is not avoid the lenders and consider (not necessarily accept) any solutions that they propose.

Stop Eviction

We liken the stop eviction order to a big water dam. These power of sale and foreclosure processes need to be dealt with sooner or later, and the pressure is building. Delaying these processes for three months during normal times would result in a considerable backlog. Before recent events, the Canada-wide mortgage default rate stood at roughly 0.2%. Predictions from the Bank of Canada state that the default rate could increase significantly.

One thing we are assuming is that any measures to process all the built-up legal actions must be done slowly. The courtrooms in Ontario get pretty busy on a typical day, so they’d likely be overwhelmed with four times the amount of work. The Ontario government is trying to mitigate this by encouraging people to file their court documents online. Ontario courts’ websites were recently revamped with new features, making them much easier to use than before. We’d also assume that there would be some sort of limit on the number of evictions each month. Flooding the market with power of sale properties would negatively impact Canada’s housing market. I’m unsure if local sheriff’s offices have enough staff to process so many evictions simultaneously.

Conclusion

A lot of people who get Notice of Sale documents decide to sell their home on their own shortly after. Selling can be a smart move in cases where getting a new mortgage isn’t possible. So, a sudden increase in property listings can serve as a hint of what is going on.

If you are facing power of sale or foreclosure, don’t wait for the situation to worsen. Contact Mortgage Broker Store now for expert advice and personalized solutions. Our team specializes in navigating these challenging situations and can help you find the best path forward. Email ron@mortgagebrokerstore.com or call 416-499-2122. Let us help you take control of your mortgage situation today.