Owning your own home comes with its distinct advantages. Yes, covering monthly housing costs is a huge commitment. It may require re-prioritizing different aspects of your life. Do you need to buy that expensive cup of coffee on the way to work every day? Can your kids survive on one less extracurricular activity? Maybe movie nights at home can become the routine rather than expensive take-out.

Certainly, if anything, the global pandemic has taught us that we don’t “need” as much as we think we do. Our priorities have changed as a result of being forced into lockdown and long periods of being at home.

Many homeowners have looked around their homes and determined what would make them more comfortable as work-at-home becomes the norm. Rather than use the money to go shopping for unnecessary purchases and spending it on a night on the town, money towards renovations, updates and fixes have taken center stage. After all, now more than ever, your home has become your sanctuary.

The pandemic also ran contrary to many financial forecasts. Nowhere more felt than the housing sector. With home values soaring to new heights and properties being snapped up in a record number of days on the market, Ontario real estate has experienced a boom over 2020 and into the first half of 2021, rather than a bust as was widely feared.

According to the Toronto July Housing Report, the average price of a single detached dwelling has hit an all-time high of $1.1 million. Houses sell in an average of just 14 days on the property market.

With newly found property gains it may be time to consider the option of tapping into the existing equity in your home and taking out a second mortgage to cover dream renovations and/or any other pressing financial obligations.

Let the Equity in Your Home Work to Your Financial Advantage

To fully understand the distinct advantages of utilizing the equity in your home it is useful to be familiar with what equity is exactly. In simple terms equity is the amount your house is worth subtracting what you still owe on your property. The equation looks like this:

- House Appraised value- $200,000

- Mortgage amount owing- $80,000

- Total equity to date- $120,000

The equity you have available in your home equals $120,000 in this equation. This amount can be utilized by applying for a second mortgage on your property. Of course, there are different second mortgage options available to a homeowner using existing equity:

- Debt consolidation loans- By accessing available equity in your home, a debt consolidation loan can be used to apply your plans to upgrade your home and make it as livable as possible in the post-pandemic new normal.

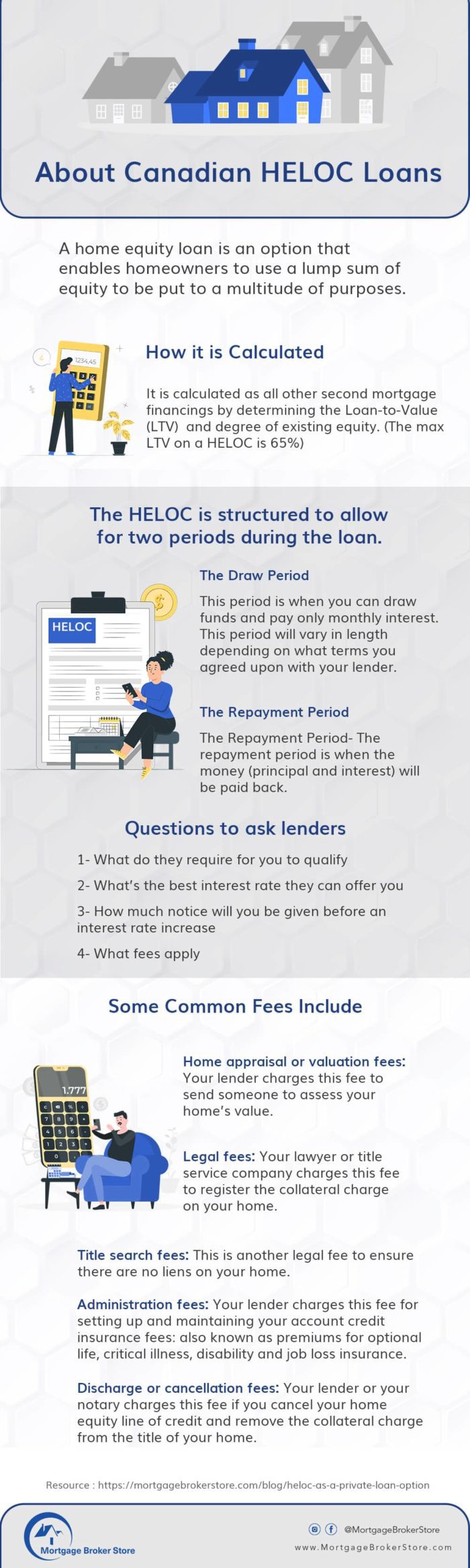

- Home equity loans- A home equity loan is a second loan option that enables homeowners to use a lump sum of equity to be put to a multitude of purposes. It is calculated as all other second mortgage financings by determining the Loan-to-Value (LTV) and degree of existing equity

- Home Renovation loans– As the name suggests, a debt consolidation loan is a second mortgage type, utilizing existing home equity that allows a homeowner to merge all outstanding liability payments in one easy-to-manage monthly payment.

- Refinancing a principal mortgage- If the terms of your primary mortgage may be unsuitable, a second mortgage can provide the funds to help cover primary mortgage payments and negotiate some of the contract terms.

A Home Equity Line of Credit (HELOC) May Be the Best Answer to Tap into Your Home Equity

Another option open to homeowners with significant equity built in their homes is a Home Equity Line of Credit (HELOC). This second mortgage option acts like a revolving line of credit enabling funds to be available as the balance is paid off, a homeowner only needs to pay the monthly interest on the line of credit.

A HELOC may be an attractive option for some homeowners because a homeowner can continuously borrow against a line of credit within a designated period and up to a designated amount.

The HELOC is structured to allow for two periods during the loan.

- The Draw Period- This period is when you can draw funds and pay only monthly interest. This period will vary in length depending on what terms you agreed upon with your lender. Generally, if you apply for a HELOC privately, the term length will be much shorter for the loan itself. Private mortgage financing will tend to be 1 to 3 years in length.

The amount you can draw on will depend on the LTV calculated by your private lender, the amount of equity that is currently available, and a certain overall debt ratio. A private lender will not lend more than 75% LTV for any second mortgage option. This directly relates to the increased risk associated with second mortgages on properties that are already mortgaged.

- The Repayment Period- The repayment period is when the money (principal and interest) will be paid back. For the long-term, bank negotiated HELOCs this time could represent the period similar in length to a principal amortized mortgage (for a 30 year HELOC the repayment could represent 20 years for example with a draw period of 10).

What are the two biggest “Draws” to a HELOC for current homeowners?

- The funds are drawn over some time vs as one lump sum-instead of drawing out a lump sum of money and making payments on this amount, a HELOC allows a homeowner to draw on the funds on their timeframe and according to their needs over time.

- The HELOC is structured as an Interest only loan- Homeowners are required to pay the monthly interest payments only during the draw period of the loan.

Associated Fees and Rates

If a homeowner chooses to take out a HELOC through a private lender, there will be associated fees that a lender will be charging to offset costs and cover administrative costs. Generally, for all second mortgage loan options (including HELOC’s) a homeowner should expect to pay between 3% to 6% of the total cost of the loan in fees.

The interest rates on a HELOC will tend to fall between 7% to 12% depending on the degree of equity, appraised value, and particular financial picture of the homeowner.

Mortgage Broker Store Can Negotiate Different Types of Second Mortgage Loan Options

With access to a broad network of well-established and experienced private lenders across Ontario, Mortgage Broker Store can connect an interested homeowner to private lenders to discuss various private second mortgage loan options, including possible bridge financing. We will also be able to negotiate private financing directly, depending on your specific financial objectives. Poor credit and non-traditional income need not be a barrier to obtaining a bridge loan or any other loan to help pay off any pressing monthly liabilities. Don’t hesitate to contact us at your convenience to discuss the best options to suit your unique financial circumstances.