All Ontarians have been through the most extraordinary year. The ongoing pandemic has tested our ability to adapt. We have been forced to adjust our working lives, households, and daily routines amidst a global pandemic that is still yet to be over.

Among some of the shifts in thinking, many Ontario-based homeowners have realized the need to have living spaces that are both comfortable and will enable one to be in a good position to resell in a robust Ontario housing market. With more and more employees working remotely from home and Ontario home sales at record levels, Ontario homeowners are also looking to use existing equity in their homes to take out secured mortgage loans.

Looking to profit from the Ontario real estate sector, many have turned to banks for mortgage loans. With stringent criteria to meet along with mortgage stress tests that rely heavily on near-perfect credit scores to pass, some Ontario homeowners have turned to independent mortgage brokerages and private mortgage brokers to obtain a mortgage loan.

Although the majority of mortgage brokers in Ontario are operating legally, it is always advisable to practice due diligence when seeking mortgage advice and securing mortgage financing. Statistics do reflect the reality that some mortgage brokers may not be above board with their mortgage practices. According to Equifax, suspected fraudulent mortgage applications have increased by 52 percent in Canada since 2013, with the majority of these applications stemming from Ontario.

How to Verify a Mortgage Lender?

The mortgage industry is regulated just as other sectors of the economy. Each Province has a Provincial Regulator in place that oversees mortgage activities and mortgage brokers. These regulatory bodies allow for general oversight of an ever-changing industry and ensure that mortgage brokers are adhering to Provincial mortgage laws.

When researching potential mortgage brokerages and/or independently operating mortgage brokers it is important to do your research and determine if they are legitimate and working under the Provincial legal requirements. Verification comes down to contacting the Provincial regulator that registers all mortgage brokerages and mortgage agents.

Do Mortgage Brokers Have to Be Licensed?

In 2006 the Mortgage Brokerages, Lenders and Administrators Act was passed mandating that all Ontario-based businesses and individuals who carry out mortgage brokering activities must be licensed and registered with the Provincial regulator that is responsible for overseeing the mortgage sector in the Province.

In Ontario, the Provincial regulator that oversees the activities of the mortgage sector is the Financial Services Regulatory Authority (FSRA).Just as in the other Provincial regulators, FSRA’s overall mandate is to both protect the public interest and enhance public confidence in the mortgage sector. Every Ontario-based mortgage broker must be registered and licensed with FSRA to operate legally in this Province.

When accessing FSRA resources, individuals can see the details of all licensed Ontario-based brokers. By simply looking at FSRA’s Mortgage Brokerages, Administrators, Mortgage Agents, and Mortgage Brokers Licensed in Ontario searchpage on FSRA’s Website you will be able to make an inquiry about the broker or agent you are researching. According to FSRA, as of September 30, 2016, there were 2,681 licensed mortgage brokers and 10, 893 licensed mortgage agents.

FSRA has the authority to conduct investigations and register complaints which can be beneficial information when researching which Ontario-based mortgage agent you may want to work with. Valuable information that can include whether a Mortgage holder not only holds a valid license but whether there are any past disciplinary decisions against them, suspensions, or are subject to restrictions or conditions.

If a broker that you have encountered does not appear on FSRAs list of licensed Ontario mortgage agents, then you can enquire further with FSRA to determine whether the broker in question may work for a financial institution ( mortgage brokers working with a bank do not need to be licensed) or determine if they be under a different license. FSRA has the authority to investigate any broker that is not licensed or does not fall under another category such as being employed by a bank. Enforcement action may be taken.

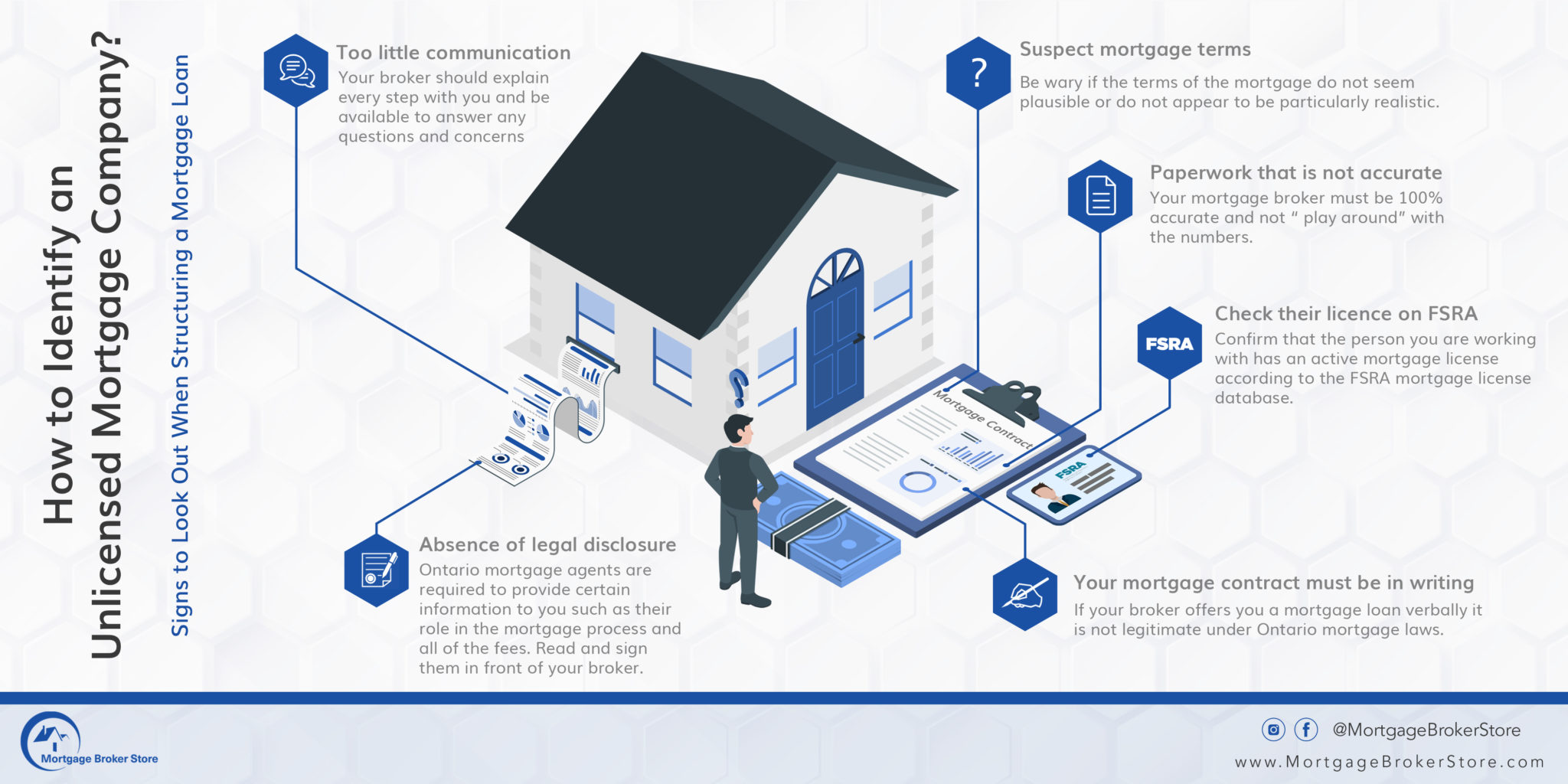

Signs to Look Out When Structuring a Mortgage Loan

What sorts of practices may raise some alarm bells when sitting down with a potential mortgage broker? There are rules and a structure that is followed when negotiating mortgage deals. There are necessary paperwork and forms that you will be required to fill out and these documents must be signed. A reputable mortgage firm will usually have a broker that will act as a chief compliance offer and will be supervising the mortgage staff and hold the brokers and staff accountable. If the following is present then one should be very suspect:

- Too little communication– Your broker should explain every step with you and be available to answer any questions and concerns.

- Paperwork that is not accurate- When listing assets, employment information, salary, and other relevant information your mortgage broker must be 100% accurate and not “ play around” with the numbers. These documents are considered legal documents and are signed.

- Absence of legal disclosure– Ontario mortgage agents are legally required to provide certain information to their clients such as the role they will play in the mortgage process and any fees that they will be charging. These disclosure forms must be read and signed in front of your broker.

- Suspect mortgage terms– the age-old adage “ if it is too good to be true..” certainly applies when negotiating mortgage loans. Be wary if the terms of the mortgage do not seem plausible or do not appear to be particularly realistic.

- Your mortgage contract must be in writing– Mortgage contracts are ALWAYS in writing. The necessary forms must be signed, including relevant disclosure forms and a Lender Commitment Letter. If your broker offers you a mortgage loan verbally it is not legitimate under Ontario mortgage laws.

Mortgage Broker Store Can Help Guide You in Making Informed Mortgage Decisions

Mortgage Broker Store can help address any concerns you may have concerning the legitimacy of your mortgage contract and further advice in terms of licensed mortgage brokerages. With particular expertise in the legal aspects of default methods such as the power of sale and contacts with well-experienced private lenders based in Ontario, we will be able to help you negotiate a private mortgage loan if the banks have turned you down.