Life can often throw us curve balls that can force homeowners to face harsh financial realities. Job losses, sudden illness, or unexpected home repairs can make it difficult to meet mortgage payment deadlines.

According to a 2016 Bank of Canada Survey of Financial Security, one in five households can only make up to two months of mortgage payments using liquid assets, and about one-third can make up to four months of payments.

Mortgage arrears occur when a homeowner misses or is late with a payment. This is different from a default, where the terms of the mortgage agreement are not honoured.

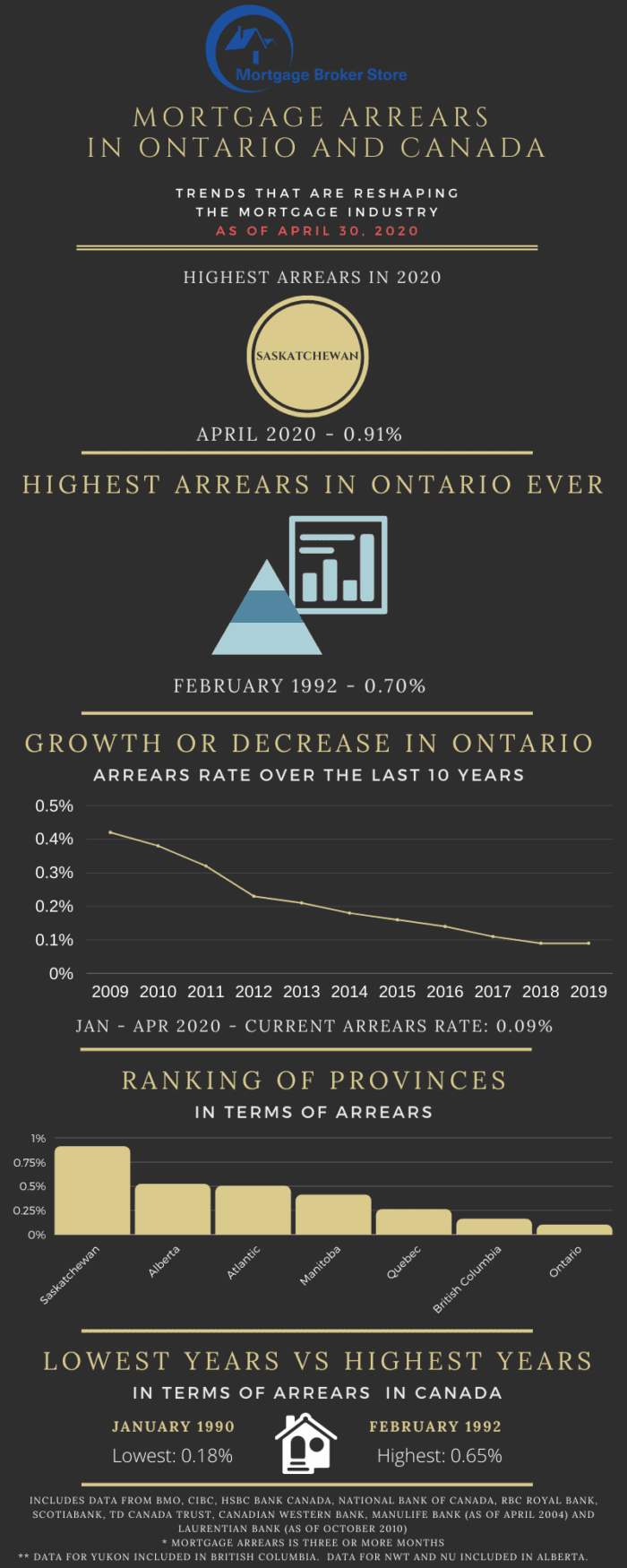

In 2020 alone, The Canadian Bankers Association reported 0.25% of mortgages were in arrears across Canada. The financial crisis of 2008 led to a decrease in interest rates, causing a surge in home purchases. Now, just 12 years later, homeowners are suffering yet another economic crisis, paired with a pandemic that has forced many Canadians into financial flux.

Statistics Canada

In August Statistics Canada announced the worst economic performance in the country in 50 years with the GDP falling to a record low of 38.7% for the quarter, the worst posting for the economy since data was first recorded in 1961.

Mortgage arrears rates hit their highest levels at the peak of the economic crisis in 2009, topping out at 0.45%.

In May, Federal Housing Agency President and CEO Evan Siddall tweeted:

“We believe 14% of mortgages are still in deferral. Not all will go into arrears, and not all of that subset will result in foreclosure. The ultimate results are unknowable as they are a function of house price levels, demand, supply, rates< unemployment, govt supports, etc.”

The pinch is being felt across the country with homeowners unable to make their mortgage payments. The hardest hit are The Prairies with homeowners in Saskatchewan (with an arrears rate of 0.91 percent) seeing the highest levels spiking sharply between 2014 and 2020.

Analysts believe this may be due to higher unemployment rates and a slowing real estate market. A younger population, compared to other parts of Canada, taking on too much debt is also believed to be driving the rise in mortgage arrears across Saskatchewan.

Other provinces are not immune:

- Alberta 0.52

- Atlantic Canada 0.50

- Manitoba 0.41

- Quebec 0.26

- British Columbia 0.16

- Ontario 0.10

Ontario Stats

In early October, Central Bank Governor Tiff Macklem noted governments around the world are looking at many options including negative interest rates.

The Bank of Canada is predicting a rise in the proportion of households whose debt-service payments exceed 40% of income, leading to more homeowners falling into arrears.

Once seen as a booming housing market, homeowners in the province of Ontario have seen their arrears levels decline over the past 10 years, dipping to 0.10%. However, this decline is not expected to last.

Ontario, particularly in major urban centres like Toronto, continue to see booming home sales. According to an Insights report by TransUnion Canada, mortgage loan balances across Canada increased 3.4% with Ontario leading all provinces with year over year growth rates averaging 4.8% driven by active markets including Hamilton, Ottawa and Toronto, with balance growth rates ranging from 5% to 8%.

“We are now starting to see increased pressure on personal finances, especially within certain segments of the population that have a higher sensitivity to interest rate changes. Rate rises in 2018 may be beginning to squeeze household budgets and drive higher delinquency and insolvency rates,” said Matt Fabian, director of financial services research and consulting for TransUnion Canada.

Foreign buyers also continue to prop up Ontario’s housing market with half of all real estate transactions in GTA were driven by foreign buyers snapping up property in Toronto.

Without continued support from the government and lenders, the Bank of Canada predicts arrears rates to reach 1.3% by early 2021, a level not seen since the recession of the 1980s, leaving homeowners scrambling to keep on top of their payments.

Mortgage Broker Store

Traditionally the lowest levels of arrears happen during good economic times and rise during an economic downtown. Experts believe that may not be as severe this go-around as the Canadian government, banks and private lenders continue to offer new programs to help support homeowners.

Taking the time to look at your options with a mortgage expert can help prevent your financial situation from getting worse and prevent bad credit due to missed payments. If you’d like a free consultation on your situation, call 416-499-2122 or email ron@mortgagebrokerstore.com, and we will get back to you the same business day.