What is a good credit score in Canada for a mortgage? Many are in the process of house hunting in the robust Ontario property market. Existing homeowners are also looking into second mortgage options using gains in property appreciation during the last year. Regardless of your specific mortgage goals, one of the most important variables that mortgage financing success will hinge on is your credit score and overall creditworthiness.

Lenders in all lending categories will be looking at your credit history and credit score. Not only will your credit score affect whether you can obtain mortgage financing, but it will also relate to the final interest and fees that will be associated with a mortgage loan you are eventually approved for.

Apply for a Mortgage Loan

When applying for a mortgage loan through the big banks, which mortgage providers classify as A lenders, the approval criteria rest primarily on creditworthiness, including your credit score (Beacon Score). Banks will also be looking at yearly incomes that can easily be demonstrated. If you wish to be approved by a bank, your credit score needs to be over 600. Credit scores can range from 300, which is considered very poor, to 900, which is considered exemplary.

There are two major credit reporting agencies in this country, Equifax and Transunion. Regardless of which reporting agency we are referring to, their primary role is to assign a credit score to an individual based on several defined criteria.

From these criteria, your credit score is determined and allocated. It is important to note that a credit report is essentially a snapshot of your credit performance at any given time and there are ways to improve your credit score moving forward.

Self-Employed Individuals

If you are working on a contractual basis or are self-employed it will also be difficult to convince the bank to loan out a mortgage because income becomes harder to easily demonstrate. By the same token if you approach a bank with a Beacon Score of less than a minimum of 600 you will likely be turned away.

There is the option of turning to credit unions or established trust companies; however, you will need to demonstrate a credit score of around 550 with a substantial down payment to be considered for a standard mortgage loan. Private lenders are available for Ontario-based homeowners/borrowers if credit is causing difficulties with the mortgage application.

When Ontario homeowners/borrowers are turning to traditional lenders, namely the banks, one of the first things that is determined is the borrower’s overall credit score. Remember, the banks ultimately want to lend out as little as possible with the lowest level of risk.

By assessing a borrower’s credit score the banks are essentially analyzing what degree of risk any given individual represents when it comes to recouping the lender’s money. The credit score in the lending business tells the story. It represents essentially a snapshot of the lending history of an individual and his or her reliability and consistency in terms of repayment.

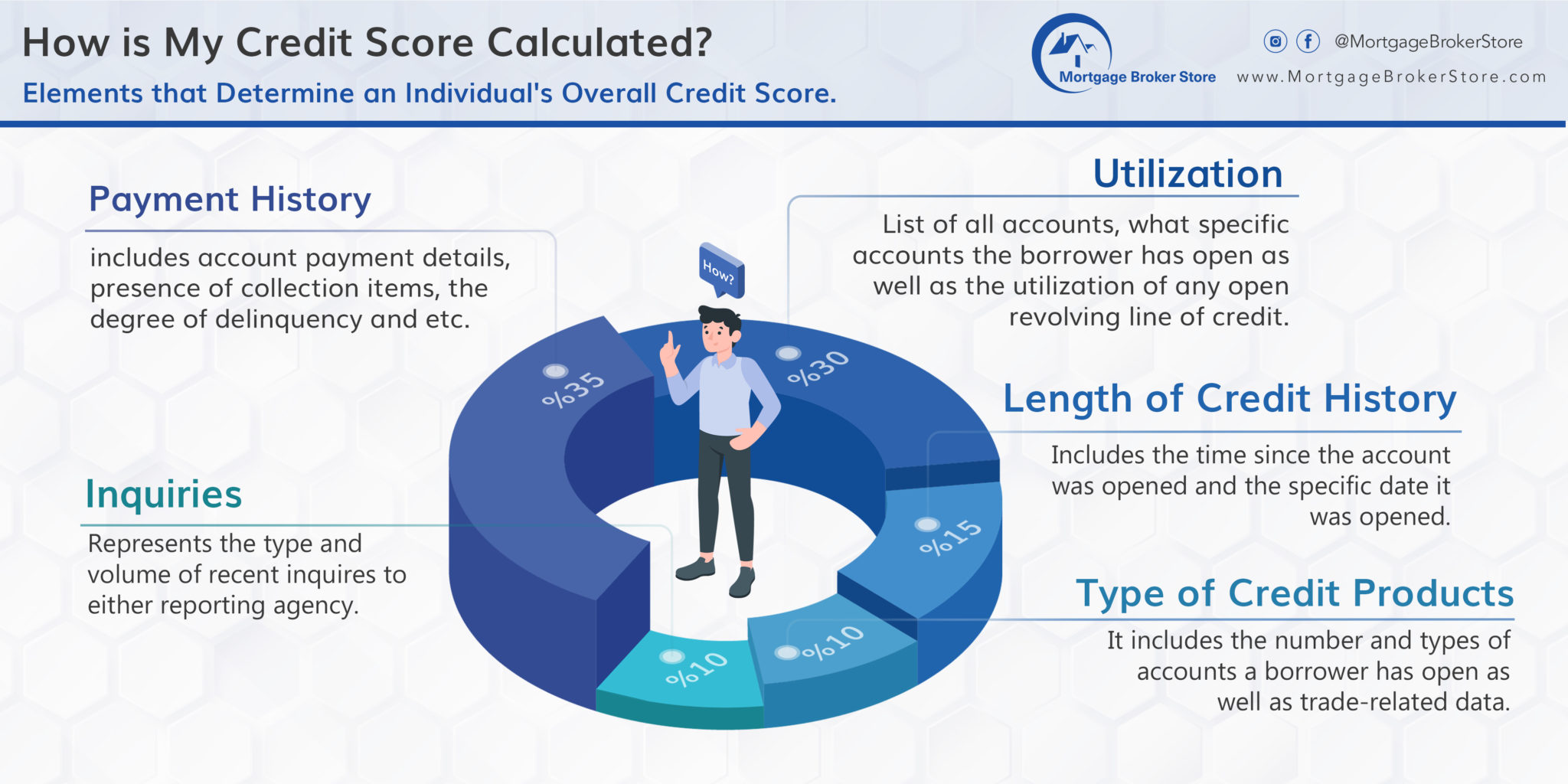

Both reporting agencies in this country, Equifax and Transunion have not provided mortgage professionals with the exact way in which they come up with your ultimate credit score. However, there is no doubt that they are analyzing specific criteria. The chosen criteria form the basis of the calculations that they ultimately make. Below is a brief outline of the elements that are assessed when determining an individual’s overall credit score.

Credit Score Assessment Criteria

Payment History- This represents approximately 35% of the total credit score and includes account payment details, the presence of collection items, the degree of delinquency and number of past due payments as well as the dates of any recent collection actions.

Utilization– Approximately 30% of the total credit score comprises a list of all accounts, specific open accounts, and their utilization.

Length of Credit History– This represents approximately 15% of the overall credit score and will include the time since the account was opened and the specific date it was opened.

Type of Credit Products– This represents approximately 10% of the credit score. It includes the number and types of accounts a borrower has open as well as trade-related data.

Inquiries– Recent inquiries to reporting agencies represent about 10% of the overall credit score by type and volume.

The majority of people have no idea how the tiniest little hiccup can affect one’s credit score. This likely results from many people not inquiring about the factors determining their credit score. You should be very aware of what your credit score represents from a personal standpoint.

This knowledge is invaluable. All lenders analyze credit reports to understand borrowers’ credit scores and the factors influencing them. What variables have affected a borrower’s score? How has the borrower managed their credit? What is the overall creditworthiness of a borrower?

What Should Your Credit Score Be to Buy a House?

In the process of seeking mortgage financing, knowing your credit report inside out is probably one of the most important preliminary steps in the mortgage process. The amount of a mortgage loan largely depends on the lender’s assessment of your reliability as a borrower. They have obtained this information from your credit report. Your credit score will also be pivotal in reaping the benefits of extremely low borrowing costs. The higher your credit score- the lower the interest on your loan.

Having said this, the question arises as to what credit score is needed to buy a house. Generally, a bank will be demanding a credit score of higher than 600 with preference given to 650 and above. Other lenders will have less stringent credit criteria. Trust companies and credit unions will accept credit scores of 550. The third classification of lenders in Ontario that will be able to arrange mortgage loans despite low credit scores and damaged credit are private lenders (referred to as C lenders).

How to Maintain Good Credit Throughout the Mortgage Application Process

To increase your chances of securing mortgage financing with the best possible rates, there are things you should avoid doing while you are in the process of applying for a mortgage loan:

- Do not take out any other loans (liabilities) while you are applying for a mortgage loan.

- Try not to make any unnecessary credit inquiries after you obtain your credit report and review it carefully.

- Ensure to consistently pay all bills on time and in full, before, during, and after your mortgage application approval.

- Try to pay off any high interest loans such as credit cards.

Using Credit for Home-Related Purchases and Maintenance

Ontario homeowners seeking to capitalize on recent substantial appreciation gains have various options for second mortgage loans. Despite credit challenges, Ontario homeowners can access home equity through secured private mortgage loans. Some second mortgage loan options include:

- Home Equity Line of Credit (HELOC)

- Home Equity Loan

- Home renovation loans

- Bridge financing

- Negotiating new terms on your principal loan

- Debt consolidation loans

Mortgage Broker Store Can Direct You Towards Suitable Private Mortgage Options

At Mortgage Broker Store we have access to a network of established Ontario-based private lenders. We can determine the type of mortgage financing that will suit your financial objectives. We can guide you to a private lender for secure mortgage loan terms.

Poor credit does not have to stand in the way of securing mortgage loans. Whether you are seeking a first mortgage to purchase a home or would like to tap into the existing equity in your home, private lending options are available to help make these mortgage goals achievable.

Mortgage Broker Store can help connect an Ontario homeowner to an appropriate private lender to meet home equity loan needs. Continually strive to find the best match when looking at your particular mortgage and financing goals. We work with Ontario private lenders, guiding you through crucial decisions in the lending process. We will steer you in the right direction in your mortgage search. Call us at 416-499-2122 or email ron@mortgagebrokerstore.com to take the next step!