There’s an undeniable financial shift in Canada. In 2025, many Canadians will see mortgage rates increase due to economic pressures and policy changes. Household budgets have become strained from significant payment increases, and 1.2 million fixed-rate mortgages are up for renewal. The mortgage market continues to evolve, featuring rigid lending standards, soaring interest rates, and a new demand for private lending. This article explains the reasons behind the changing mortgage costs. It will examine private lending trends using data from the Canada Mortgage and Housing Corporation (CMHC) and provide strategies to budget and refinance effectively to face the challenges ahead.

The 2025 Mortgage Landscape

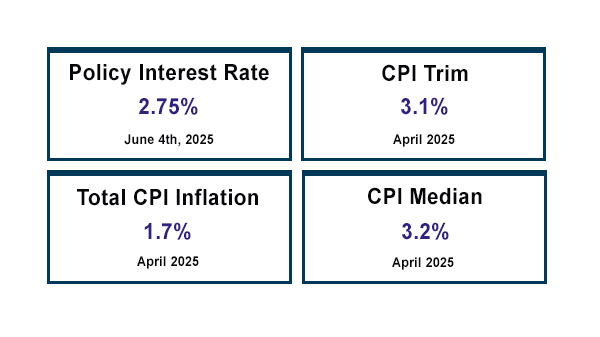

The mortgage market is changing. The Bank of Canada’s efforts to keep inflation at bay resulted in sky-high interest rates impacting fixed and variable-rate mortgages. CMHC’s Housing Market Outlook reports that fixed-rate mortgages will likely remain elevated, while variable-rate mortgages may see some relief if policy rates decrease. There are 1.2 million homeowners with mortgages set initially at 1% to 2%. Now, they face a staggering increase in their rate to 3% to 4%. Homeowners with a 1 million mortgage at 2% used to pay about $4,233 monthly, but with a 4% increase, they now pay $5,275 – over an extra $1,000 for their monthly expenses!

Of course, economic factors are prompting these challenges. CMHC data indicates a decline in mortgage originations, with property purchases and refinancing down from previous years. In 2022, chartered banks initiated $191 billion in mortgage loans. That’s a 7.9% drop from 2021. Non-bank lenders issued $110 billion. Looking at the delinquency rates, they show an upward movement and are choking at pre-pandemic levels sometime before 2025. Less credit is available these days and is subject to stringent criteria. Setting aside higher expenses thus becomes paramount for maintaining financial stability in the homeowner’s life.

Understanding Mortgage Rate Increases

The rate hikes by the Bank of Canada are intended to curb inflation and borrowing costs, especially those of fixed-rate mortgages, whose yields are heavily dependent on bond yields. CMHC predicts that fixed rates will remain elevated. Meanwhile, variable-rate mortgages are connected to the bank’s policy rate. This could result in benefits from the cuts, but these reductions will unlikely fully offset payment shocks for renewing borrowers.

The risk of delinquency is also rising. CMHC’s Fall 2024 Residential Mortgage Industry Report states an increase in second- and third-stage delinquencies. This means that there is a financial strain among homeowners. Of the 1.2 million borrowers renewing in 2025, some secured mortgages at peak housing prices with low rates. Higher payments could consume a substantial amount of the household income. This could result in buyers entering survival mode, focusing only on immediate needs. This could lead to reduced consumer spending and affect the economy at large. Lenders are increasing provisions for expected losses, indicating they are concerned about borrowers’ meeting payments in this high-rate environment.

Private Lending: An Alternative Avenue

Private lending has become an avenue for borrowers not qualifying for conventional mortgages. CMHC’s Residential Mortgage Industry Data Dashboard shows that non-bank lenders held 19% of the mortgage market. These lenders help high-risk borrowers with low credit scores or unstable incomes.

Flexibility is private lending’s most excellent offer, but it comes at a cost. Private mortgages tend to have shorter terms, resulting in a 2% to 3% increase in conventional mortgages. CMHC data shows that non-bank lenders issued $110 billion in mortgage loans in 2022 in high-demand areas. However, they also note that the impactful mortgage value decreases due to the end of contracts.

Budgeting for Higher Payments

Managing higher mortgage payments in 2025 requires careful planning. CMHC believes 85% of renewing borrowers will encounter rates higher than the initial 1% to 2%. Households must reassess their budget by creating a detailed plan prioritizing only the essential expenses, and cut down on travelling or dining out. CMHC’s online mortgage calculators can help estimate new payment amounts to aid in budgeting.

Having a financial cushion is also essential. CMHC data shows that delinquency rates are rising, and emergency savings are more important than ever. Homeowners should aim to save three to six months’ worth of mortgage payments. Additional income sources are also valuable. This could include part-time work or renting out part of the property. The local economy could be affected if too many people reduce their spending due to high mortgage payments.

Refinancing and Mortgage Renewal Tips

Obtaining good terms will take some work for anyone needing to renew or refinance in 2025. Marketing data from CMHC shows that refinances fell by 13.3% in 2022 due to cautious lending and borrower fitness. Renewal clients should compare offers from various lenders, banks, credit unions, etc. Payments are fixed in a fixed-rate mortgage, making it a greater guarantee for borrowers, many of whom would prefer this method in over 55% of cases. The contrary holds with variable-rate mortgages- they may be a saving if policy rate drops are realized, lowering payments in due course.

Homeowners should also opt for a shortened amortization period to reduce the interest paid, which raises monthly payments. A mortgage broker will open up a broader spectrum of lenders for consideration and assist in negotiating better terms. According to CMHC’s dashboard, low loan-to-value scenarios are stabilizing, and therefore, borrowers with greater home equity can probably land at better rates. For those under tight financial situations, early discussions with lenders to defer payments or extend terms should keep them from the slope, primarily as market liquidity should still facilitate property sales for those who need to exit.

2025 will give Canadian homeowners a challenging mortgage environment. This can include rising interest rates, tighter lending standards, and a high incidence of private lending. Understanding what makes rates rise, utilizing CMHC data on private lending trends, and implementing proactive budgeting and refinancing initiatives will help absorb the cost increase. Homeowners must use the lenders’ offerings to lessen payment shocks, build financial buffers, and consider alternative financing options. With such a challenging economic environment, staying informed and acting early will be the most significant stabilizing factor.